virginia electric vehicle tax credit 2022

State andor municipal tax breaks may also be available. Beginning January 1 2022 a resident of the Commonwealth who purchases a used electric motor vehicle from a participating dealer with a sale price as provided by 581-2401 of not more than 25000 shall be eligible for a rebate of 2500.

This irs tax credit can be worth anywhere from 2500 to 7500.

. Prior to Jan. The credit is also transferrable. Federal solar investment tax credit.

The fee is included with registration fees and must be paid at the time of original registration and each year at renewal. In its final form the program which would begin Jan. Reference Virginia Code 462-770 through 462-773 Electric Vehicle EV Parking Space Regulation.

The state of Virginia is not the only sector willing to reward customers for the purchase of an EV as well as a Plug-In Hybrid PEV. Virginia Electric Vehicle Tax Credit 2022. Reid D-32nd would have granted a state-tax rebate of up to 3500.

Pursuant to 581-4003 of the Code of Virginia certain electric suppliers are required to pay a minimum tax rather than a corporate income tax for any taxable year their minimum tax liability is greater than their corporate income tax liabilityThe minimum tax would be equal to 145 of the electric. EV owners must pay an annual highway fee of 109 in addition to standard vehicle registration fees. The credit amount will vary based on the capacity of the battery used to power the vehicle.

Electric vehicles that get 200 or more miles of range would qualify for a 2000 rebate for new and 1000 for a used vehicle. Either fax your application to 804 367-6379 or mail it to. Latest On Tesla Ev Tax Credit March 2022.

Tuesday May 10 2022. This incentive covers 30 of the cost with a maximum credit of up to 1000. Beginning July 1 2022 EV drivers may choose to enroll in a mileage-based fee program in lieu of highway use fee.

A qualified resident of the Commonwealth who purchases such vehicle shall also be eligible for an additional 2000. The legislation will be introduced when the Virginia General Assembly convenes on January 13 2021. President Bidens EV tax credit builds on top of the existing federal EV incentive.

The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same. The minimum federal PEV tax credit is 2500 but could be as much as 7500 depending in the PEVs battery capacity weight and one other key factor well discuss in a minute. All-electric vehicles EVs registered in Virginia are subject to a 8820 annual license tax at time of registration.

You can qualify for the additional 5000 if. The amount of the credit will vary depending on the capacity of the battery used to power the car. And potentially even more importantly these tax credits will be refundable.

Opens website in a new tab. Virginia electric vehicle tax credit 2020. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits.

Reference Virginia Code 581-4391202 Agriculture and Forestry Biofuel Production Grants. DMV Registration Work Center. Cap is 6 million per year.

Virginia State And Federal Tax Credits For Electric Vehicles Pohanka Chevrolet. Hybrid car tax credits work by giving you a nonrefundable credit on your income tax return. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

Tesla to get access to 7000 tax credit on 400000 more electric cars in the US with new incentive reform. Either fax your application to 804 367-6379 or mail it to. 2500 towards the purchase or lease of a new or used battery electric or plug-in hybrid electric vehicle.

The current credit offered to ev buyers is for up to 7500 usd and is set to increase if the bill passes in the senate. If you take home a new PEV that meets certain requirements such as battery capacity overall vehicle weight and emission standards you can also receive a federal tax credit of up to 2500. Virginia electric vehicle tax credit 2022.

Download and complete the License Plate Application VSA 10 including the vehicle identification number VIN and title number. Several states and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate. Standard and Charge Ahead Rebates can be combined for up to 7500 toward the purchase or lease of a new eligible vehicle.

You may be able to get a maximum of 7500 back on your tax return. Virginia electric vehicle tax credit 2022. Friday May 13 2022.

Vehicles would have to be made in the united states starting in 2027 to qualify for any of the 12500 credit. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits. Electric Vehicle EV Fee.

1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. The incentives go up as high as 12500 on new cars and up to 4000 on used electric vehicles. Beginning July 1 2022 EV drivers may choose to enroll in a mileage-based fee program in lieu of highway use fee.

Reference Virginia Code 101-130704 Electric Vehicle EV Fee. Rebates can be claimed at or after purchase while tax credits are claimed when filing income taxes. For more information see the Virginia DMV Electric Vehicleswebsite.

Richmond EV Readiness Plan May 3 2021. An enhanced rebate of 2000 would also be available to buyers whose household income is less than 300 percent of current poverty guidelines. Check that your vehicle made the list of qualifying clean fuel vehicles.

The federal tax credit falls to 22 at the end of 2022. Reference Virginia Code 462-770 through 462-773. The annual highway use fee will be updated yearly on July 1.

An annual highway use fee will be assessed on each electric motor vehicle registered for highway use in Virginia. January 1 2020 to December 31 2022. Reference Virginia Code 581-2217 and 581-2249 Electric Vehicle EV Rebate Program Working Group.

As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. All Those Electric Vehicles Pose A Problem For Building Roads Wired. Find state and local-specific incentives available in your area.

EV owners must pay an annual highway fee of 109 in addition to standard vehicle registration fees. An EV with at least a 5 kWh battery capacity can snag you another 417 plus another 417 for each kWh above that 5 kWh threshold.

South Korea Aims To Push Ev Innovation Electrive Com

List Of Most Efficient Cars In 2022 Dominated By Electric Vehicles Cleantechnica

Electric Vehicles Tax Credit By Car Model Manufacturer 2021

Pros And Cons Of Electric Cars Energysage

6 Best Electric Cars Over 100 Mpge For 2022 Truecar

Ev Charging Electric Vehicle Charging Station Installation

Electric Car Mpg Top Brands Compared Energysage

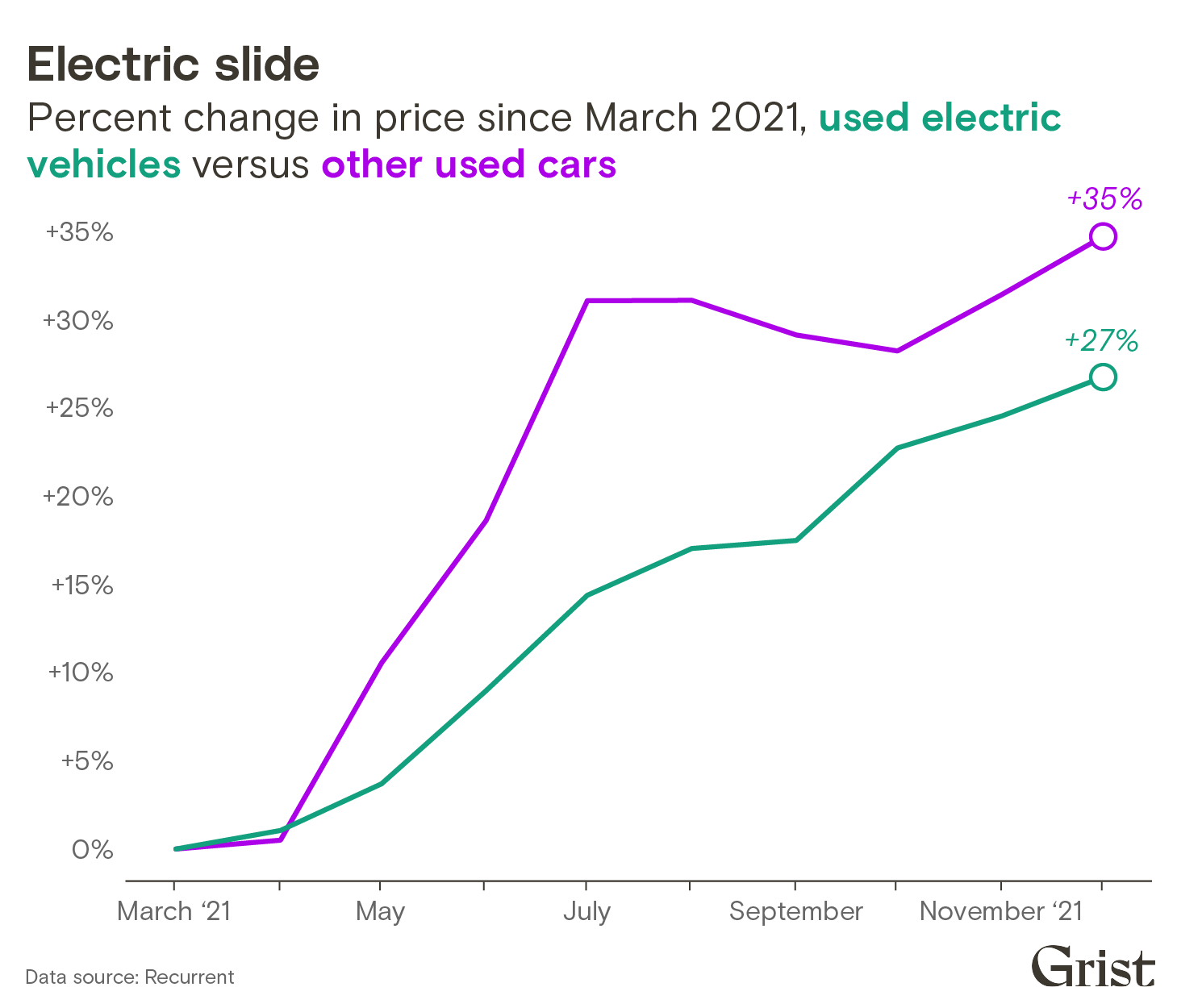

High Gas Prices Have A Lot More People Searching For Electric Vehicles Grist

Democrats Electric Vehicle Push Sparks Intense Lobbying Fight The Hill

Harris Touts Administration S Electric Vehicle Plans Roll Call

High Gas Prices Have A Lot More People Searching For Electric Vehicles Grist

Democrats Push Forward With Ev Tax Credits Roll Call

Coinbase Dashboard Illinois West Virginia South Dakota

How Much Does It Cost To Charge An Electric Car Yaa

The Reason Most Americans Are Choosing Electric Vehicles Might Surprise You Getjerry Com

Rebates And Tax Credits For Electric Vehicle Charging Stations

List Of Most Efficient Cars In 2022 Dominated By Electric Vehicles Cleantechnica